Medicaid 101: Part 8 – Spousal Refusal or “Just Say No”

March 23, 2018

Medicaid 101: Part 10 – Long-term Planning for Medicaid

April 5, 2018Part 1 of this Medicaid blog series generally discussed the Medicaid program and its eligibility requirements. For most Medicaid applicants seeking long-term care coverage, there is both an income and an asset test for eligibility. Refer to Part 1 and the corresponding sections regarding those eligibility requirements.

The Affordable Care Act implemented the Medicaid expansion program. This program is often referred to as Modified Adjusted Gross Income Medicaid, or “MAGI.”

The MAGI program expands Medicaid coverage to adults with low income. Under the MAGI eligibility rules, there is no asset test. Instead, the only consideration is the household’s adjusted gross income.

Who Qualifies For MAGI?

There are various categories of MAGI eligibility. Unless otherwise noted, this MAGI discussion will address only long-term care Medicaid (Medicaid to cover the cost of nursing home, assisted living, or in-home care).

If an individual is younger than 65 years of age and is not receiving Medicare benefits, he or she can qualify for long-term care benefits under the MAGI program.

If an individual is 65 years or older, he or she must qualify using the traditional eligibility requirements discussed in Part 1.

Likewise, if an individual is under age 65 but qualifies for Medicare due to the receipt of Social Security Disability for at least two years or otherwise, the individual cannot qualify for MAGI Medicaid and must use the traditional eligibility requirements discussed in Part 1.

In addition to long-term care Medicaid, adults under age 65 who are not receiving Medicaid can qualify for MAGI Medicaid for insurance purposes. For example, a young couple with low income can obtain health insurance through the MAGI program.

What are the MAGI eligibility standards?

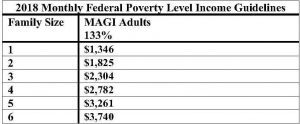

For an individual to qualify for MAGI Medicaid, he or she must have low income. For MAGI Medicaid, income is calculated in the same way income is calculated for federal income tax purposes. The modified adjusted gross income as calculated on the individual’s 1040 is compared to the MAGI Medicaid eligibility table below:

The family size is determined by the dependents living in the household (or, the same number of people claimed on the income tax return).

When a single individual applies for MAGI Medicaid, his or her modified adjusted gross income must be less than $1,346. If his or her income exceeds that amount, he or she cannot qualify for MAGI Medicaid.

Spousal Impoverishment laws apply to MAGI Medicaid. The goal of Spousal Impoverishment laws is to protect the healthy spouse from being impoverished by the unhealthy spouse’s medical costs. The Community Spouse Resource Allowance (Part 6) and Monthly Income Allowance (Part 7) were implemented as part of the Spousal Impoverishment protections.

For MAGI Medicaid eligibility for a married applicant, the couple’s modified adjusted gross income is compared to the applicable eligibility limit in the chart above. If the individual is ineligible because the couple’s income exceeds the limit, the spouse’s income is subtracted from the household income. Then, the applicant’s income alone is compared to the applicable household size to determine eligibility.

Example

Steve is 55 years old, lives at home, and is in need of waiver services. He has monthly income of $1,500. Steve’s wife, Tracy has monthly income of $2,000. Their current assets total $100,000.

Steve and Tracy have household income of $3,500. For a household of 2, their income exceeds the MAGI-eligibility limit of $1,800. Because Steve is applying for waiver services, spousal impoverishment rules apply. Without Tracy’s income, Steve’s income of $1,500 is compared to the income eligibility limit for a household of 2. Because Steve’s income is less than $1,825, he qualifies for MAGI-based Medicaid.

Non-traditional Aspects of MAGI

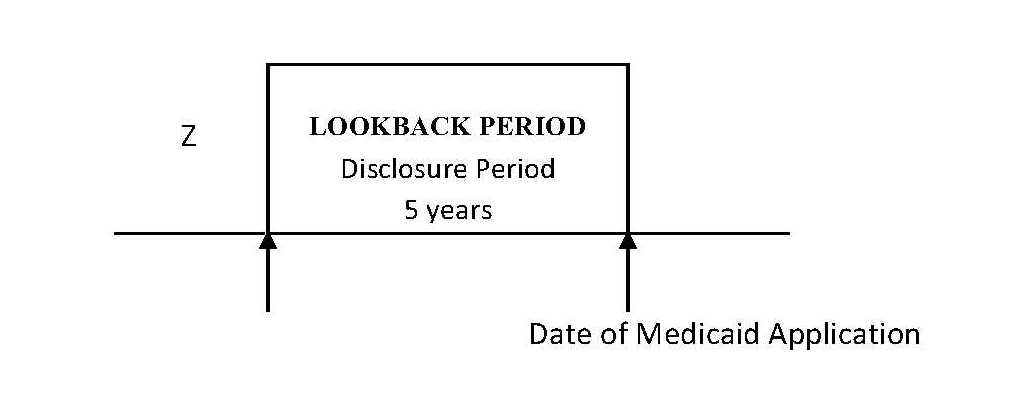

Under the traditional Medicaid eligibility standards, the Medicaid applicant will be subject to the five-year lookback period and transfer penalties. The applicant will also owe a patient liability each month to the facility or long-term care provider. The applicant is also subject to specific asset eligibility rules.

Under the MAGI program, the individual is only subject to the five-year lookback if he or she is applying for nursing home benefits. If the individual is applying for assisted living facility benefits or in-home benefits, the five-year lookback rule does not apply.

Additionally, MAGI recipients do not owe a patient liability toward the cost of their care, nor are they subject to any asset limits.

Additional Considerations

MAGI eligibility rules allow individuals to qualify for long-term care benefits more quickly than the traditional eligibility rules. However, a MAGI recipient will eventually lose coverage once he or she reaches age 65 or qualifies for Medicare benefits. It is important to plan for the transition from MAGI rules to the traditional eligibility rules, because if the individual does not meet the separate income and asset tests for long-term care, his or her benefits will terminate.