Taps & Sutton named #20 on the Law Firms: Central Ohio Largest Family Law Practices

February 27, 2020

Stimulus Check: Does it Affect Medicaid, and What if the Recipient is Deceased?

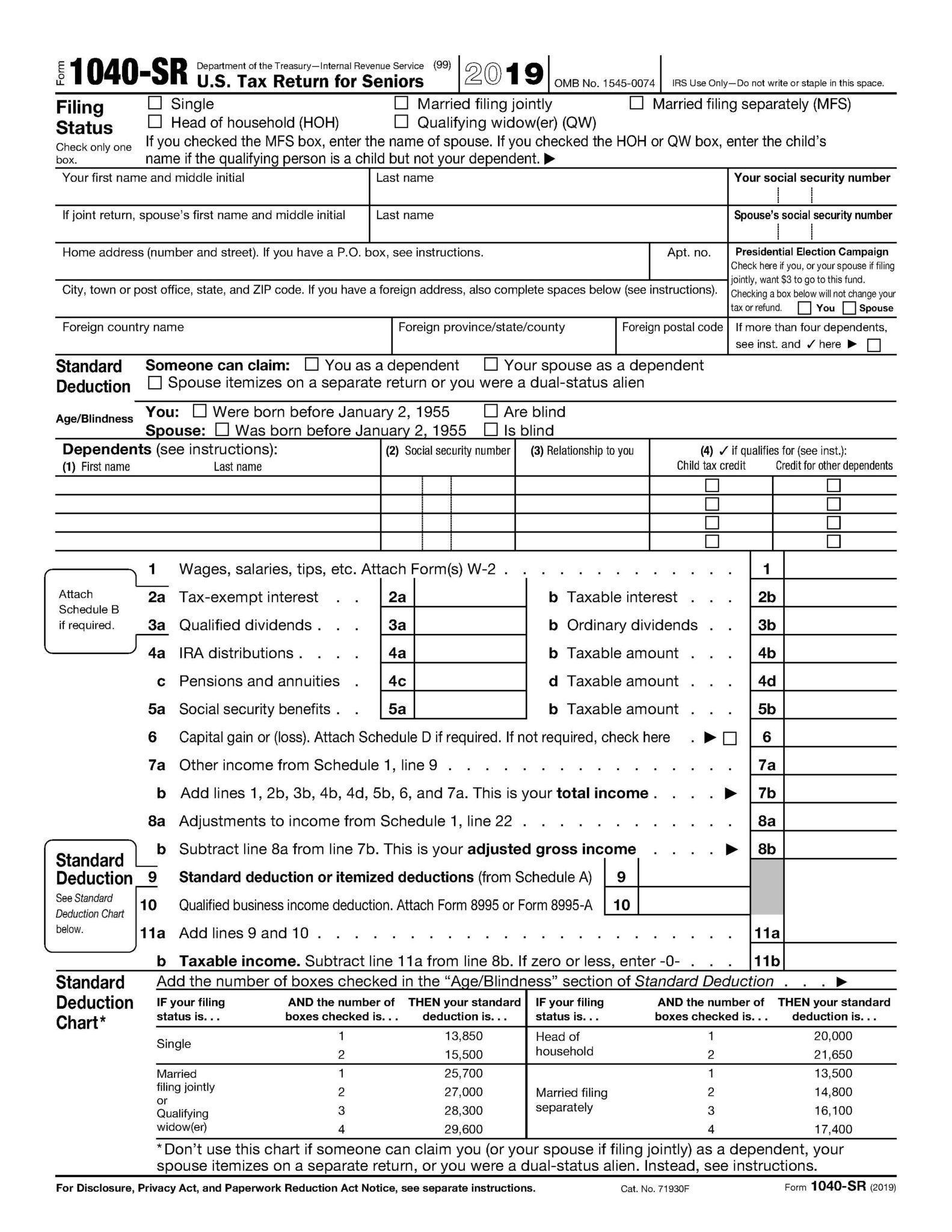

May 7, 2020Nobody likes tax season, but tax time can especially be a struggle for seniors needing to file an income tax return. For many seniors, the cost of paying a tax preparer can be overwhelming, and the tax forms are not necessarily easy to read or complete without the help of a computer or a professional tax preparer.

That all could be changing this year. The IRS has released a new 2019 tax return form – the 1040-SR – designed specifically for seniors. The form is only two pages long and has specific lines for the types of income most seniors will need to report, including Social Security income, IRA distributions, pensions, and annuities.

The form itself uses larger print and removes some of the shaded boxes and other elements of a regular 1040 that made it difficult for seniors to read and complete on their own.

In this CBS article about the new form, Kristian Finefrock, founder of Retirement Income Strategies, says about 10% of taxpayers (15 million people) could qualify to use the form.

As with any tax situation, if a senior has a more complicated income picture – like itemized deductions or income other than retirement-type income, the 1040-SR may not be the best option and a professional tax preparer will be needed.

But, for a significant segment of the population, this new form could make filing annual income taxes a little less painful.