Medicaid 101: Part 9 – Expansion Medicaid

March 29, 2018

New Medicare cards to be issued – beware of scams

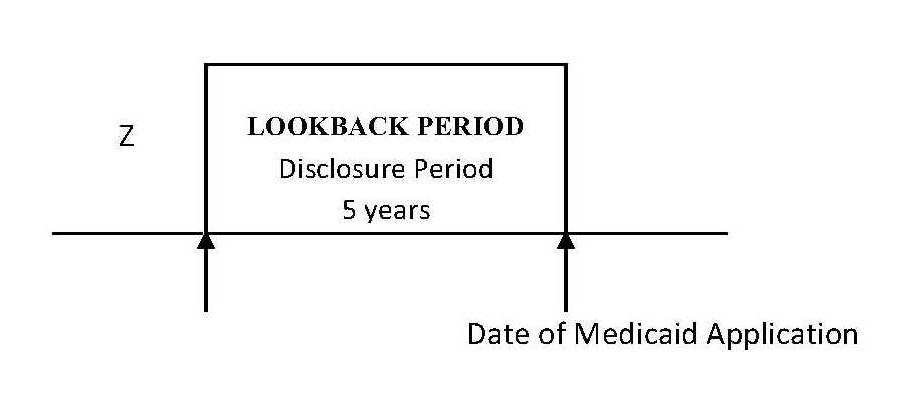

April 10, 2018Part 5 of this blog discussed the five-year lookback period for Medicaid eligibility. If any gifts or transfers of assets are made in the five years preceding the filing of a Medicaid application, the applicant may be penalized for those gifts or transfers.

Any transfers made more than five years before a Medicaid application is filed (represented by the “Z” in the above drawing) do not affect the applicant’s eligibility and do not need to be disclosed during the Medicaid application process. Because of this, many individuals wish to implement a plan more than five years before they expect to need long-term care. The goal of these plans is to protect assets, usually for a spouse or children.

To successfully implement a five-year plan, the individual (or couple) must give up complete control of the asset he or she is wanting to protect. Retaining control or access will not completely divest the individual of that asset, and the asset will continue to be available for Medicaid eligibility purposes. There are generally two options to divest assets to protect them: gifting directly to a person(s) or gifting to a trust.

Gifting to a Person

Some individuals want to protect assets for the benefit of their children. They often have the idea of making an outright gift to the children with the understanding that the children will hold onto the funds and use the funds for the parents if they need it later. Other times, parents intend to make a gift to one child with the idea that the child will hold the asset until after the parents have died, and the recipient will divide the asset among his or her siblings.

There are some benefits to giving a gift to children during your life. If the gift is made more than five years before a Medicaid application is filed, the individual will not be penalized for the transfer and the asset will be fully protected for the child’s enjoyment. Any assets transferred prior to the five-year lookback period will also avoid Medicaid Estate Recovery after the parent’s death (see upcoming part 12). Depending on the nature of the gift, the parents can experience the joy of seeing the child receive the gift.

However, there are some disadvantages to making a direct gift to children. First, the children may not hold onto the funds for the parents’ benefit if they need it in the future. Even with the best of intentions, the children often spend the money or use it in a way that it will no longer be available to the parents if necessary. The funds also become subject to any creditors the children may have. The funds could be subject to division in a divorce proceeding, attachment during a bankruptcy filing, or a court judgment if the child is in an accident or otherwise sued. There is no guarantee of protecting those funds for the parents’ benefit.

Moreover, even with the best of intentions, there is no legal guarantee that the recipient will share those assets with his or her siblings after the parents’ deaths. No matter how trustworthy or honest a child may be, there is nothing requiring that child to share the assets given to him or her. As discussed above, that child may spend the funds or be subject to creditors. That child could fail to keep the funds separate from his or her own assets and have no way to identify the gift to distribute after death.

If clients have an only child, the issue of splitting gifts among siblings is not an issue, so outright gifts to that child may make sense. Most often, however, a trust is the safer alternative for protecting assets in a five-year plan.

Gifting to a Trust

Making gifts into a trust have most of the same benefits as above: if the transfer to the trust is made more than five years before a Medicaid application is filed, the individual will not be penalized for the transfer and the asset will be fully protected for the child’s enjoyment. Any assets transferred prior to the five-year lookback period will also avoid Medicaid Estate Recovery after the parent’s death (see part 12).

Additional benefits for a trust include protection from creditors and legally enforceable division between multiple beneficiaries after the parents’ death. Assets held in the trust will not be subject to any beneficiary’s creditors, and the terms of the trust can provide very specific distribution terms to ensure that all children receive the share of the assets that the parents intend.

Trusts can have disadvantages, as well. First, to effectively protect assets for Medicaid purposes, the trust must be irrevocable and the individuals creating the trust must give up complete control of the assets put into the trust. Once the trust is signed and assets are transferred, there is no way (generally speaking) to change the trust terms or beneficiaries. This can be a major consideration for individuals and couples who want to plan ahead. Individuals in their 50s and 60s may not be ready to give up total control and access to assets, and they may also not be ready to definitively decide the distribution of assets at their death.

Another downside to trusts can be the tax implications. There are many considerations with regard to trusts and taxes, including capital gains provisions and step-up in tax basis. These considerations change depending on the type of assets to be placed into the trust (i.e. cash in a checking account vs. real property vs. brokerage accounts or stocks).

While the trust terms can be flexible and account for various family, life, and tax events, it takes a great deal of time and care to be sure the plan will work from all angles. Because a trust plan can be a drastic step, it is important to get legal advice from an attorney who understands the issues involved.

Planning Involving the Home

For many people, protecting the home is a primary goal. When it comes to protecting the value of the home, there are some specific planning options to consider. Planning with the home can involve outright gifts to a child, transferring the property to a trust, and reserving a life estate, among others.

It is important to be sure the individual is protected by having some legal right to live in the home, though he or she may be transferring ownership to another person or entity. The rules regarding transfers of the home are very specific, and each situation can be different. It is important to implement planning with the home that works for the facts involved in a given situation.

Durable Financial Power of Attorney

A Durable Financial Power of Attorney (DFPOA) does not directly affect assets or work to protect them. However, if you are trying to plan ahead for long-term care, a DFPOA is an important document to have.

The DFPOA allows an individual to name an agent (or agents) to act on the individual’s behalf with regard to the individual’s assets, money, and property. There are general powers and authority included in a DFPOA, but there are some specific powers to include for future Medicaid planning.

Perhaps an individual or couple does not want to create a trust or give up control of assets now, but they may want to do so in the future. Life can be unpredictable, and a health event may prevent the individual from planning for himself or herself. If the DFPOA contains specific powers for Medicaid planning (gifting, trust creation, and beneficiary designation powers, for example), the agent may be able to create a plan on the individual’s behalf. Usually this plan will be more of a “crisis plan” (see upcoming Part 11), but creating a strong DFPOA is something to create in advance.

Other Considerations

Setting up estate planning documents to protect assets and future Medicaid eligibility can be an important step for older individuals. Long-term planning can involve other aspects, as well.

For example, does life insurance or long-term care insurance make sense for the individual or couple? Are there any specific steps that should be taken regarding a certain asset or investment? Getting financial planners involved in the long-term planning process can be just as important as the legal aspects.

Additionally, talking to spouses, children, and other family members about beliefs and wishes is important. Some individuals want to remain at home as long as possible. Some families will plan for children to provide in-home care to parents, while others will rely on hired in-home help. Some individuals have preferences for long-term care facilities and health systems.

For many people, talking about long-term care and estate plans is not fun. We don’t like thinking about getting old and needing help to care for ourselves. But, planning ahead and thinking through these issues can help make the transition easier and ensure that elderly individuals get the care they need, while also ensuring that their family and financial goals are met.