Medicaid 101: Part 5 – Five-Year Lookback Period and Penalties

March 1, 2018

Medicaid 101: Part 7 – Spousal Monthly Income Allowance

March 15, 2018Part 1 of this Medicaid blog series generally discussed the Medicaid program and its eligibility requirements. Part 2 discussed the Assisted Living Waiver program, and Part 3 addressed the PASSPORT program. This post will refer to all three programs collectively as “long-term care” Medicaid.

While each of these programs has a specific set of eligibility criteria, some criteria apply to all three programs, including the spousal eligibility and impoverishment rules.

Married Medicaid Applicant

When a Medicaid applicant is married, the county caseworker will use a specific calculation to determine the resource limit for eligibility. The amount that the healthy spouse, often referred to as the “community spouse” or “CS,” can keep is called the Community Spouse Resource Allowance.

The Community Spouse Resource Allowance (CSRA) is determined using the Snapshot Date.

Snapshot Date

The snapshot date is the first date the spouse seeking Medicaid eligibility (“Institutionalized Spouse” or “IS”) enters a long-term care facility (LCTF) and stays for at least 30 days. The snapshot date is the first day of hospitalization if the patient directly transfers from the hospital to a nursing home or rehabilitation facility. A married individual will only have one Snapshot Date, regardless of how many times the individual has been hospitalized or in a nursing home. If there are multiple 30-day stays, the individual’s Snapshot Date will be the first day of the first 30-day stay.

The caseworker determines what the couple’s countable assets are as of that date (the caseworker takes a “snapshot” of the countable assets).

Countable assets include any asset the couple owns that has a cash or fair market value. The home will be an exempt resource and not count toward the couple’s asset total so long as the CS or a disabled child lives in the home. Additionally, the couple’s most valuable vehicle used for transportation is exempt and does not count toward the couple’s asset total.

Depending on the types of assets the couple owns, other assets may be exempt under the Medicaid regulations. An elder law attorney who is familiar with the Medicaid regulations and application process can help you determine whether any other assets may be exempt from the resource total.

For purposes of determining the asset total as of the Snapshot Date, it does not matter how the assets are titled (wife’s name, husband’s name, or joint).

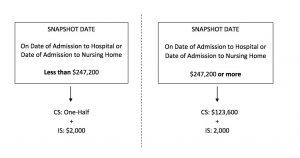

Once the Snapshot Date amount has been determined, the caseworker will calculate the CSRA based on the diagram below:

If, as of the Snapshot Date, the couple’s countable resources were less than $247,200, the CS will be entitled to keep an amount equal to one-half of the Snapshot Date total. The IS is allotted $2,000.

If the couple’s Snapshot Date resource total exceeded $247,200, the maximum amount the CS can keep is $123,600. The IS is still allotted $2,000.

By adding the CSRA and $2,000, the couple will have a goal figure. The IS cannot obtain Medicaid eligibility until the couple’s countable resources are below that goal figure.

Example 1:

Joe and Sandy are married. Joe had a heart attack and was admitted to the hospital on January 11, 2018. From the hospital, he transferred to rehab at the nursing home, and once he completed rehab, he became a resident of the nursing home. It is now March 2018, and Sandy wants to explore Medicaid eligibility for Joe.

Joe’s Snapshot Date will be January 11, 2018.

As of January 11, 2018, Joe and Sandy had bank accounts, IRAs, and mutual funds totaling $310,000.

Joe and Sandy fall on the right side of the diagram above. Because their Snapshot Date total exceeded $247,200, Sandy can keep a total of $123,600 in countable resources, and Joe can keep $2,000. Their goal figure for Joe’s eligibility is $125,600 ($123,600 + $2,000). Before Joe can be eligible for Medicaid benefits to cover his nursing home cost of care, Joe and Sandy need to spend down their assets to $125,600 or less.

Example 2:

Assume the same basic facts as above, except that on January 11, 2018, Joe and Sandy had countable assets totaling $200,000. Now, Joe and Sandy fall on the left side of the diagram above.

Sandy can keep one-half of their Snapshot Date total, or $100,000. Joe can keep $2,000. Their goal figure for Medicaid eligibility is $102,000 ($100,000 + $2,000). Before Joe can be eligible for Medicaid benefits to cover his nursing home cost of care, Joe and Sandy need to spend down their assets to $102,000 or less.

Valid Spenddowns

Before submitting a Medicaid application for a married individual, it is important to determine the CSRA calculation as accurately as possible. Once the couple knows the goal figure and the amount of excess resources they have, they can spend down their assets accordingly.

The couple must spend their assets on items or services benefitting themselves. Any funds used to benefit a third party, or an exchange of countable assets for less than fair market value, will be presumed to be an improper transfer and a penalty period will be imposed. (See Part 5 for further discussion.)

The most commonly-used spenddowns include paying debts (for example, a mortgage or credit card), purchasing personal property, paying for home improvements and repairs, purchasing irrevocable, prepaid funeral plans, and buying a more expensive car or home.

In addition to utilizing these types of spenddowns, there may be other planning options to help reduce the couple’s countable assets to the goal figure. This planning can be complicated and often involves trusts or annuities.

If the planning is not done correctly, an individual’s Medicaid eligibility could be jeopardized. While the information in this and other posts are intended to help clients understand the process, it is important to seek legal advice from an attorney who understands the nuances of Medicaid eligibility and permissible spenddowns.