Medicaid 101: Part 6 – Snapshot Date and Community Spouse Resource Allowance

March 8, 2018

Medicaid 101: Part 8 – Spousal Refusal or “Just Say No”

March 23, 2018Part 1 of this Medicaid blog series generally discussed the Medicaid program and its eligibility requirements. Part 2 discussed the Assisted Living Waiver program, and Part 3 addressed the PASSPORT program. This post will refer to all three programs collectively as “long-term care” Medicaid.

While each of these programs has a specific set of eligibility criteria, some criteria apply to all three programs, including the spousal income allowance rules.

Monthly Income Allowance

When a married person applies for Medicaid, only his or her income will be subject to a patient liability calculation (see Part 4). The healthy spouse (known as the “community spouse”) can keep all his or her income and will not be required to spend it on the Medicaid applicant’s care.

Depending on the community spouse’s own income amount, he or she may be entitled to a portion of the institutionalized spouse’s (the spouse applying for Medicaid) income. The total amount of the institutionalized spouse’s income to which the community spouse is entitled is called the Monthly Income Allowance (MIA).

The MIA is calculated by adding the Minimum Monthly Maintenance Needs Allowance and the Excess Shelter Allowance and subtracting the community spouse’s own income:

Minimum Monthly Maintenance Needs Allowance

Ohio Medicaid regulations allow the community spouse to receive a minimum amount of income each month. This number is adjusted every July for inflation. As of July 2017, a community spouse is entitled to at least $2,030 in income each month. This is known as the Minimum Monthly Maintenance Needs Allowance (MMMNA).

To the extent that the community spouse’s own income does not reach the MMMNA amount, the community spouse is entitled to the institutionalized spouse’s income.

For example, if a wife has income of $1,800 per month and her husband qualifies for Medicaid, the wife will be entitled to $230 of her husband’s income each month ($2,030 – $1,800).

The community spouse may be entitled to additional income each month if he or she has high shelter expenses (see below), but the MMMNA is capped at $3,090 (2018). If the community spouse’s own income exceeds $3,090, he or she will not be entitled to any of the institutionalized spouse’s income. Likewise, if the community spouse has income below $3,090 and is entitled to some of the institutionalized spouse’s income, the community spouse will only be allowed to receive enough income to bring the community spouse’s income to $3,090 per month.

Excess Shelter Allowance

A community spouse may be entitled to monthly income that exceeds $2,030 if he or she has high shelter expenses. Shelter expenses include utilities, homeowner’s insurance, condo fees, and rent/mortgage payments. The Excess Shelter Allowance gets added to the MMMNA to arrive at the total Monthly Income Allowance for the community spouse.

To calculate the Excess Shelter Allowance, the caseworker will use the following formula:

If the community spouse pays for at least one home utility, he or she will get credit for the Standard Utility Allowance. The current Standard Utility Allowance is $530. The Excess Shelter Standard is subtracted from all the shelter expenses to arrive at the Excess Shelter Allowance. The current Excess Shelter Standard is $609.

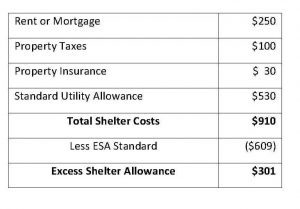

Here is an example of how the Excess Shelter Allowance is calculated:

Assume that the wife is the community spouse. Her mortgage payment is $250, property taxes are $100, and property insurance is $30. Her total shelter costs are $910:

The wife would be entitled to an additional $301 per month from her husband’s income.

Taking the example from the Monthly Maintenance Needs Allowance section above, the wife would be entitled to a total Monthly Income Allowance of $531 ($2,030 + $301 – $1,800).

Here’s an example using the MMMNA cap:

Assume the wife has $2,800 per month of her own income. Also assume that she is entitled to the same Excess Shelter Allowance above ($301). The wife would be entitled to $301 of her husband’s income, except that the MMMNA is capped at $3,090. Therefore, she can only receive $290 per month of her husband’s income.

Reduction in Patient Liability

To the extent that a community spouse is entitled to a Monthly Income Allowance, the institutionalized spouse’s patient liability is reduced. See Part 4 for further discussion.

Additional Notes

Calculating a community spouse’s Monthly Income Allowance is an important part of the Medicaid application process. Sometimes, the caseworker miscalculates the Monthly Income Allowance and a state hearing may be necessary to correct the calculation. Additionally, some planning options may generate additional income for either the institutionalized or community spouse, and it is important to consider how the additional income would affect the patient liability and/or Monthly Income Allowance.